- The eBay Community

- Discussion Boards

- Buying & Selling

- Selling

- ATO Request for Data

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 15-05-2015 11:11 AM

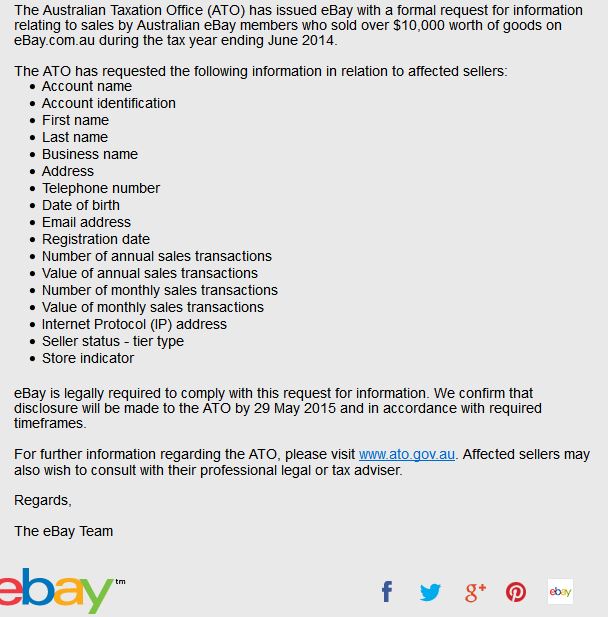

This is the first time we have received one of these since we have been trading on eBay.

Anyone else?

Solved! Go to Solution.

Accepted Solutions

ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 15-05-2015 11:15 AM

ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 15-05-2015 11:19 AM

ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 15-05-2015 11:30 AM

I got it too, and it would seem to be a retroactive request, since it states it's for the tax year ending in June 2014 (so the 2013 - 2014 tax year, and the 2014-2015 tax year still has around 6 weeks to go). I'm not sure if the lower threshold ($10k) is new or not, I guess so - it used to be $20k at any rate, but if it is new, that could explain the request for older records.

I don't expect anything to come of it, personally, as all eBay income etc was declared.

ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 15-05-2015 12:03 PM

@harley_babes_hoard wrote:my accountant said May 15th

The due date of your tax return depends on how you lodge, and whether you have any unlodged tax returns.

The normal (early) due date is 31 October 2014. This applies to anybody who lodges their own tax return.

If you lodge through a registered tax agent, you get an extension to the due date. The extension is usually until 15 May 2015, but an earlier date of 31 March 2015 applies to a small number high income taxpayers

I just phoned the accountant and she advised the 15th of May is the standard date, but she was able to lodge a few weeks later in certain circumstances so it sounds like it depends on your accountant.

ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 15-05-2015 11:15 AM

ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 15-05-2015 11:19 AM

ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 15-05-2015 11:21 AM

I remember this came up a year or two ago when the ATO released its "annual hit list" to news and media.

They were "going after" people selling online at places such as eBay. Looks like they are doing it.

ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

15-05-2015 11:23 AM - edited 15-05-2015 11:25 AM

ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

15-05-2015 11:27 AM - edited 15-05-2015 11:30 AM

@gamesandconsolesgalore wrote:

I also received the email, although nothing new for me. I have received this email every year at tax time. As long as you are declaring all your income you will be fine. If total sales including post are above $75.000 you also need to be registered for GST. I declare all my Ebay income to the ATO so at tax time they check what Ebay report matches what I have declared on my tax return

How unusual that you have received this type of email from eBay in previous years.

I never have and would have expected to get that advice in previous years if eBay was sending out to sellers ?

Edit: actually I do recall an email or notice board announcement re tax from eBay sometime over the last couple of years, but I am fairly sure it was not in this years format.

ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 15-05-2015 11:30 AM

I got it too, and it would seem to be a retroactive request, since it states it's for the tax year ending in June 2014 (so the 2013 - 2014 tax year, and the 2014-2015 tax year still has around 6 weeks to go). I'm not sure if the lower threshold ($10k) is new or not, I guess so - it used to be $20k at any rate, but if it is new, that could explain the request for older records.

I don't expect anything to come of it, personally, as all eBay income etc was declared.

ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 15-05-2015 11:35 AM

ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 15-05-2015 11:39 AM

lol, yes, got one too.

Thats kind of funny really, the $10K threshold been reduced from $20K n $40K,

like they think they r chasing money.

Should have been the other way around, years ago $10K n now should be $40K.

Typical public servants thinking that peeps r getting massive profits from ebay.

They will be dissapointed.

ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 15-05-2015 11:40 AM

same here ony difference from all other years is a more detailed list ebay sent us instead of just saying ato requested takings.