- The eBay Community

- Discussion Boards

- Buying & Selling

- Selling

- ATO Request for Data

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 15-05-2015 11:11 AM

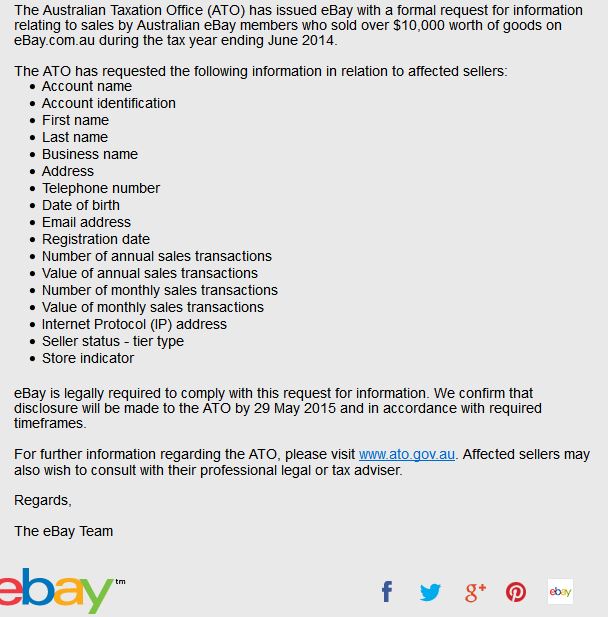

This is the first time we have received one of these since we have been trading on eBay.

Anyone else?

Solved! Go to Solution.

ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 15-05-2015 12:15 PM

I suppose the advices must be like the emails for free listings - sometimes ya get one, sometimes ya don't ![]()

ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

15-05-2015 12:15 PM - edited 15-05-2015 12:20 PM

this is all I can find about an extension to the May 15th date

https://www.ato.gov.au/Tax-professionals/Prepare-and-lodge/Tax-agent-lodgment-program/Tax-returns-by...

ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 15-05-2015 12:18 PM

I received one of these last year. I think they are just letting everyone know that the ATO is wanting to know what everyone is selling 🙂 As long as you include it in your tax return, you shouldn't have a problem.

ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 15-05-2015 12:19 PM

@vamvas123 wrote:Hi

I'm a bit lost. I too received this email and am not sure how to proceed.

I sell things on ebay as a hobby. I don't have a business or a store. What should I be doing? How can I ensure I am doing the right thing?

Thanks in advance

If you buy items to resell then you are conducting a business.

You need to speak to a tax advisor or accountant.

ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 15-05-2015 12:26 PM

@bigbrickshop wrote:The amount hasn't changed.

It was also $10,00 in last year's letter and it applied to turnover from July 2011.

Ah, ok, cheers. 🙂 This is the first time I've received an email, too, and for some reason I had always been under the impression they applied to the current tax year when they were being sent out (I was actually expecting one last year for the period in the email I got today, and was surprised I never got one. Well, until now, anyway ![]() ).

).

ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 15-05-2015 12:43 PM

no such thing as a hobby unless you sell your secondand own goods , once you sell something for a dollar thats income

ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 15-05-2015 12:47 PM

Would b nice if the sales reports from ebay were easy to get n free n in Au$ n able to cover across months n years that u select.

U know like what they have that they give to the ATO for free...:)

I've been using Paypal but it aint entirely accurate.

ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 15-05-2015 12:57 PM

I asked my tax accountant last year about the accuracy of sales reports and the like from ebay and paypal.

What he said was that as long as you are doing the best you can with the data that is available then you should not have a problem.

So I just take the "paid and posted" reports each month end as a CSV file and save those away in Excel.

This then forms the basis of my sales data for tax purposes.

I also download a CSV report each month end from paypal and tally up the fees charged in there as well as these are a deductible business expense of course. Also ebay fees that they charge us each month I log into the same spreadhseet.

I've set up my spreadsheet to gather all kinds of relevant income and expenses with guidance from my tax accountant.

Very straighforward job for him then each tax year to compile our tax returns.

We have not hit the GST threshold as yet but the same s/sheet is already capable of gathering GST data for BAS statements if/when needed.

ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 15-05-2015 12:58 PM

I think you need to be making a profit to register a business.

I think the ATO is speading millions to catch tax cheats this year (more than usual) and using a lot of data mining software, if the labor government was in power they would spend more money then they gained from actually catching the people, I guess it would catch the cheats though.

Definately be worried if anyone hasn't been declaring income.

ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 15-05-2015 01:02 PM

I do the same thing and it only takes about half an hour to compile everything, going through post office receipts takes a bit of time. I don't use an accountant though.