- The eBay Community

- Discussion Boards

- Buying & Selling

- Selling

- ATO Request for Data

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 15-05-2015 11:11 AM

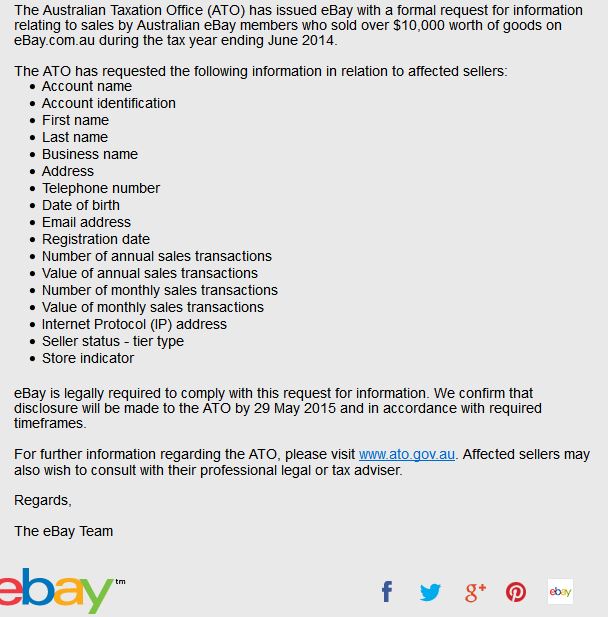

This is the first time we have received one of these since we have been trading on eBay.

Anyone else?

Solved! Go to Solution.

ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 16-05-2015 08:05 AM

to designers hi for a start the email is from ebay not the ato , the ato wants any sales over $10,000 on there files it used to be $20.000, as clary said even if your friend sold $100 worth of goods as long its her personal goods ,she has to declare that income , did your friend think they could sell and profit and dont declare an income ,its no different than working in a shop a market a lap-dancer a baker ,any money you recieve for a service is income ,its been that way for thousands of years or there abouts.

ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 16-05-2015 10:26 AM

I'm not a tax adviser so am not giving you tax advice here - ask a tax accountant about your own circumstance, but I think that if you are not running a business and your activities fit the ATO defiinition of a hobby (check the ATO website for more info) then the income is not taxable and the expenses are not deductible. It would be prudent to check the ATO website for details of what needs to be declared as income and then get an opiniion from a tax adviser to be sure if you believe you don't need to declare sales as income.

ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 16-05-2015 10:30 AM

Profit is not a requirement to register a business or to be considered to be running a business.

Best to check out the ATO website or ask your tax adviser

ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 16-05-2015 10:51 AM

I actually phoned the ATO about this last year.

They are only after the serious GST Dodgers. They're answer was that if you're not a Registered Business & only a Hobby Seller, then as long as your total Sales are below the GST Threshold of $75k then they won't look twice at you....

This is all just routine cross checking so if you are below $75k then just relax & you won't hear another word. Ebay are required by Law to disclose it now as part of the Crackdown on the big cheats....

But if you're worried then just give them a call. I found them very helpful.

ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 16-05-2015 11:05 AM

Technically it could be an intent to make profit even if not so.

ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 16-05-2015 11:08 AM

please taxable income has nothing to do with gst . gst is another thing . yes turnover over $75k means you have to lodge gst every 3 months , if its under $75 its still a taxable income ,complete 2 different things , once you buy something then sell it [you are running a business ,no diference if you sell your stock in a shop or online or in a market, its only a hobby if you are selling your own personal things . even tips are taxable you are earning money for a service, [lets say and I mean lets say one of these posters was a lap-dancer the tips guys put in there g-strings should be disclosed , I dont know how the ato can prove how much tips they get unless they check after each show , how much is hanging from there g-string lol .

and to hamsy correct about they wont look twice at you , but if the want to, well thats a diferent story, remember they have changed from $20K TO $10K and will check more now that they have halved the amount if those are not declaring those sales

ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 16-05-2015 11:11 AM

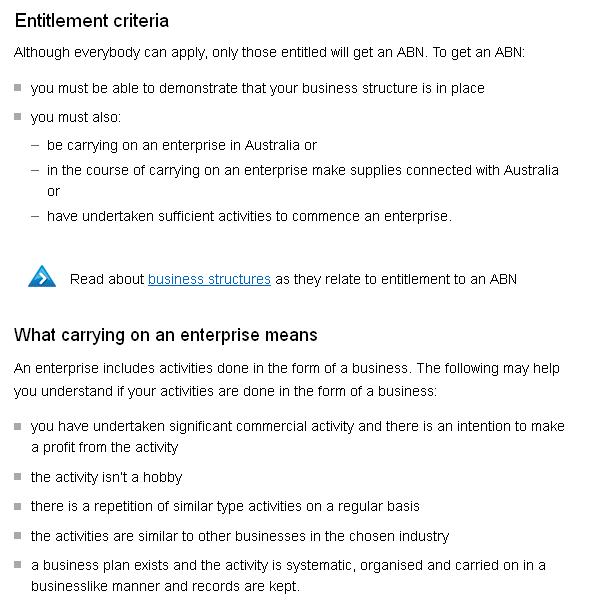

Going by the ATOs conditions on registering a business I should never had done so and therefor would not be required to collect GST as well (if I needed to as a business)

ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 16-05-2015 11:15 AM

@joethenuts wrote:please taxable income has nothing to do with gst . gst is another thing . yes turnover over $75k means you have to lodge gst every 3 months , if its under $75 its still a taxable income ,complete 2 different things , once you buy something then sell it [you are running a business ,no diference if you sell your stock in a shop or online or in a market, its only a hobby if you are selling your own personal things . even tips are taxable you are earning money for a service, [lets say and I mean lets say one of these posters was a lap-dancer the tips guys put in there g-strings should be disclosed , I dont know how the ato can prove how much tips they get unless they check after each show , how much is hanging from there g-string lol .

and to hamsy correct about they wont look twice at you , but if the want to, well thats a diferent story, remember they have changed from $20K TO $10K and will check more now that they have halved the amount if those are not declaring those sales

I think you should have a look at the image I posted from the ATOs website. I know for a fact that there are stamp dealers that do not collect GST, they declare income as everyone needs to, but if the do not collect GST then I don't think they are registered as a business. I have no doubt they make a profit from their activities.

ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

16-05-2015 11:33 AM - edited 16-05-2015 11:36 AM

@hamsy3 wrote:I actually phoned the ATO about this last year.

They are only after the serious GST Dodgers. They're answer was that if you're not a Registered Business & only a Hobby Seller, then as long as your total Sales are below the GST Threshold of $75k then they won't look twice at you....

This is all just routine cross checking so if you are below $75k then just relax & you won't hear another word. Ebay are required by Law to disclose it now as part of the Crackdown on the big cheats....

But if you're worried then just give them a call. I found them very helpful.

That may be the case last year. But the ATO has gazetted a notice advising of its intentions ito crackdown on tax avoidance in this case.

The ATO also regualrly randomly audits individuals that are not a Registered Business in any case..

And for those in receipt of Government benefits .....through ATO data matching Centrelink will pursue those individuals that has earnt $1+ and has not reported it to them.

https://www.ato.gov.au/General/Gen/Data-matching-program-protocol/

"Number of records

The total number of online selling account records to be received is estimated to be between 30,000 and 40,000. The number of affected individuals linked to those accounts is expected to be between 15,000 and 25,000"

ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 16-05-2015 11:37 AM

Here is the link for tax threshhold. I'm not saying we don't declare what we earn, just thought some may like to see what we can earn before we have to pay any tax.

The following rates for 2013-14 applied from 1 July 2013.

Taxable income

Tax on this income

0 – $18,200 - Nil

$18,201 – $37,000

19c for each $1 over $18,200

$37,001 – $80,000

$3,572 plus 32.5c for each $1 over $37,000

$80,001 – $180,000

$17,547 plus 37c for each $1 over $80,000

$180,001 and over

$54,547 plus 45c for each $1 over $180,000

The following rates for 2014-15 apply from 1 July 2014.

Taxable income

Tax on this income

0 – $18,200 - Nil

$18,201 – $37,000

19c for each $1 over $18,200

$37,001 – $80,000

$3,572 plus 32.5c for each $1 over $37,000

$80,001 – $180,000

$17,547 plus 37c for each $1 over $80,000

$180,001 and over

$54,547 plus 45c for each $1 over $180,000