- The eBay Community

- Groups

- Fun & Social

- Community Spirit

- Diary of our stinking Govt.

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Diary of our stinking Govt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 20-04-2014 10:21 PM

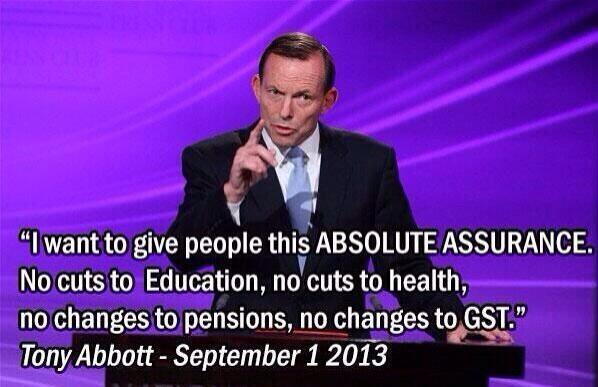

As it's more than 100 days now, it has been suggested that a new thread was needed. The current govt has been breaking promises and telling lies at a rate so fast it's hard to keep up.![]()

This below is worrying, "independent" pffft, as if your own doctor is somehow what? biased, it's ridiculous. So far there is talk of only including people under a certain age 30-35, for now. Remember that if your injured in a car, injured at work or get ill, you too might need to go on the DSP. They have done a similar think in the UK with devastating consequences.

and this is the 2nd time recently where the Govt has referred to work as welfare???? So when you go to work tomorrow (or tuesday), just remember that's welfare.

http://www.abc.net.au/news/2014-04-20/disability-pensioners-may-be-reassessed-kevin-andrews/5400598

Independent doctors could be called in to reassess disability pensioners, Federal Government says

The Federal Government is considering using independent doctors to examine disability pensioners and assess whether they should continue to receive payments.

Currently family doctors provide reports supporting claims for the Disability Support Pension (DSP).

But Social Services Minister Kevin Andrews is considering a measure that would see independent doctors reassess eligibility.

"We are concerned that where people can work, the best form of welfare is work," Mr Andrews said at a press conference.

Diary of our stinking Govt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 01-11-2014 02:23 PM

@boris1gary wrote:

Diary of our stinking Govt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

01-11-2014 02:32 PM - edited 01-11-2014 02:33 PM

@boris1gary wrote:obviously it's the continual lying that people are upset about

Lets see:

First of all B1G where has Abbott said GST will change? Only the states can change the GST not the federal govt B1G your attempt at slander on this one is wrong.. as per normal.

BUT B1G if you want all these nice socialist programs and all this money spent of health and schools etc how do we pay for it all? Taxes would be a good start but then you dont appear to like paying taxes.

So how do we pay for it all B1G

School funding.... oohh my B1G it would appear you are wrong again

Fact check: Is the Abbott Government cutting $30 billion from school funding?

http://www.abc.net.au/news/2014-07-02/kate-ellis-using-rubbery-school-funding-figures/5543330

The verdict

The Government did not cut $30 billion from schools in the May budget. It says it will change the rate of increase from 2018, which is beyond the current budget period and term of Parliament.

The $30 billion figure used by Ms Ellis is based on adding up 10 years of difference between the increases that Labor says it would have funded (4.7 or 3 per cent per year) and an estimate of the rate of increase that the current Government says it will apply (the CPI). It is a component of the $80 billion in savings that the Government itself is trumpeting.

If nothing else changes in policy or economic terms over the next 10 years, the Government will end up spending $30 billion less on schools over 10 years than Labor says it would have spent. However, in reality there is just too much uncertainty for this long-term estimate to be used as a reliable measure for cuts or savings.

Ms Ellis is spouting rubbery figures. Like the left usualy does.

Now health is the same B1G just scare tactics by you and the left.

So again b1G how do we pay for your your socialist programs if we dont tax the people?

Diary of our stinking Govt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 01-11-2014 02:32 PM

![]() what has that got to do with the LNP govt nerowulf?

what has that got to do with the LNP govt nerowulf?

Diary of our stinking Govt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 01-11-2014 02:37 PM

@boris1gary wrote:

Diary of our stinking Govt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

01-11-2014 03:06 PM - edited 01-11-2014 03:08 PM

Nice new nick you have there, very shiny and new ..... Its always a pleasure to see you back on here and posting (well not really but then I am being nice saying it is ![]()

![]()

![]()

![]()

![]() and I am in a nice mood today )

and I am in a nice mood today )

🙂

🙂

![]()

Diary of our stinking Govt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 01-11-2014 03:28 PM

I really like First Dog on the moon - apols for the hugeness, i tried to make it smaller but you can't read it.

Diary of our stinking Govt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

01-11-2014 03:54 PM - edited 01-11-2014 03:55 PM

@boris1gary wrote:

I really like First Dog on the moon - apols for the hugeness, i tried to make it smaller but you can't read it.

---------------------------------------------------

Yes funny B1G and I will give you a kudos for that one..... YES really.. I have given you kudos..... see miracles do happen an..... First Dog on the moon can be very funny from time to time.....

--------

Dunno what the below post is on about though... very odd but HEY what do I know...... ..... threats and violent images.... must have mistakenly posted it on my post as I dont see any threats or violent images... Just a funny cartoon thats political in its nature on a political thread.... .... and whats a veiled innuendo?........is a veiled innuendo like a BURQA sort of thing? 🙂

But anyway we shall move on and all be nice on here..... 🙂

@gleee58 wrote:What is that all about?

You must be confused.

For future reference, don't threaten me with your violent images or your veiled innuendo

n

Diary of our stinking Govt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 02-11-2014 04:03 PM

nerowulf wrote -

So again b1G how do we pay for your your socialist programs if we dont tax the people?

----------------------

again - I have never suggested "we don't tax people" , i will ignore the reference to "socialist programs" (sic) because if someone refuses to distinguish between social democracy and socialism there isn't much point.

Raise the GST? No thanks. Here's five better ways to fix Australia's finances

Raising the GST isn’t a good idea. It’s not even a ‘necessary evil’. It’s a sign of laziness in our policy elite

Like the arrival of the jacaranda bloom, the GST hike made its annual appearance in Australia this week. This is the hardy perennial of Australian public policy, and the usual arguments were on hand to welcome its arrival.

The federation’s revenues are broken, Tony Abbott tells us, and the only way to fix them is to “look at” the GST. John Daley of the Grattan Instituteargues that an increase would raise about $14bn, and would be a “necessary evil”. The Business Council hasn’t yet trotted out its standard line of linking the GST rise to a company tax cut, but one suspects it can’t be too far away.

These views represent a profound intellectual laziness among Australia’s policy elite. Few people question that we need to raise more revenue, but the notion that the only or even the best way to do it is through a higher GST shows an almost wilful disregard of other, better options. Here are five:

Reduce tax concessions on superannuation

The ATO estimated this concession costs the Commonwealth almost $40bn a year, with over 50% of it flowing to the top quintile of income earners. Simply shaving this concession, as Per Capita has proposed, could produce the $14 billion the GST rise is estimated to raise, without any adverse policy impact. The wealthy beneficiaries of the concession don’t need the pension anyway, and we could leave some concession in place for those who genuinely need help to avoid old-age poverty.

Abolish negative gearing

Australia is in a house price bubble which has made it near impossible for young owner-occupiers to buy first time homes, yet we still subsidise older, wealthier investors. The subsidy has done little to increase new supply, which should be its primary rationale. Conveniently this concession costs $13.8bn a year, almost exactly what the higher GST might raise.

Cut down on corporate tax avoidance

Company profit shifting to shelf companies in tax havens is calculated to cost Australia $8.4bn in lost revenue. Thanks to a raft of loopholes and concessions, nearly one third of ASX 200 companies pay an effective tax rate of 10% or less, despite a legal tax rate of 30%. Again, the revenue potential of tackling this avoidance is huge.

None of these options involves new taxes or raising existing ones. They simply involve the removal of concessions that have long outgrown their intended size and effect. Two other ideas suggest themselves:

Land taxes

In his 2010 review, Ken Henry called for consideration of a broad-based land tax in place of stamp duties. Land taxes offer several advantages - they can’t be offshored, they’re less exposed to changes in the economic cycle and they are progressive. The introduction of land taxes under state governments would lift the overall revenue base and give states much-needed control over their own revenue stream.

Tax socially costly activities

Finally, Henry also recommended that governments consider a range of taxes on socially costly activities, including congestion pricing, volumetric alcohol taxes and the elimination of gambling tax concessions. These are unlikely to raise as much revenue as a higher GST on their own, but they also reduce government spending to ameliorate the costs of these activities.

Many combinations of the above ideas would deliver just as much as a higher GST. And that’s before mentioning carbon pricing or resource rent taxes, the bêtes noires of the Australian tax debate.

So why the collective blindness? Why is the GST hike a “necessary evil”, and these other proposals greater, less necessary evils?

Well, it depends greatly on your point of view. The GST is regressive – it hits poor people harder than rich ones. So a GST hike is perhaps only a necessary evil if you have big super tax concessions and a negatively geared investment property. It is a disaster if you are a single mum, elderly, a pensioner or marginally employed.

The policy elite concedes that more revenue needs to be raised. But almost in the same breath, they dwell on what taxes might be cut with a higher GST rather than what services might be expanded.

And the word “evil” is especially revealing. It perpetuates a debate in which tax is framed as something to be minimised at all costs, rather than the price we pay for civilisation.

Diary of our stinking Govt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 02-11-2014 04:05 PM

Direct Action is a Mickey Mouse scheme says former Howard adviser

"What we've got to do is convince this government and all political leaders in this country to take real action on this," he said.

"Not this Mickey Mouse scheme that has been stitched up with the leader of a mining company."

Direct Action has been heavily criticised by economics and climate scientists, who say the scheme will fail to meet Australia's reduction target.

Mr Cousins singled out Prime Minister Tony Abbott for not doing enough to address the issue.

"When the big United Nations summit [on climate change] was on in New York [in September], only three world leaders failed to arrive and one of them was our Prime Minister," he said.

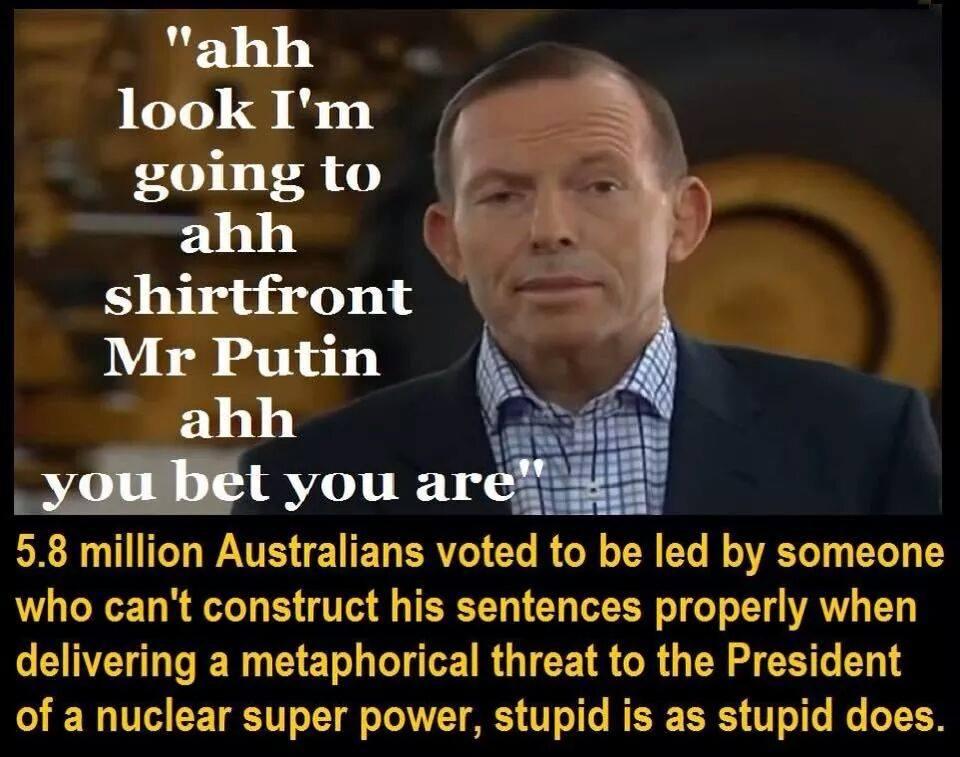

"What was he doing? Riding a bike or shirt-fronting someone? Australians aren't silly. They understand that the government is not really interested in these issue at all."

Diary of our stinking Govt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 02-11-2014 06:10 PM

@nero_wulf wrote:

@boris1gary wrote:

another badly photo shopped pic for the ongoing campaign of inciting fear and hatred against Islam, apparently its ok on cs. So this photo is from the US (surprise) and has nothing at all to do with Australia or the Greens. It is also used on a site from the US - god, country etc with a pic of some kind of weapon and the message - come and take it.

here's the accompyning blurb from the US site

Remember, if a disturbed Christian is violent, they’re a deranged person and an outlier. If a disturbed Muslim is violent, it’s because Islam is inherently violent.

Stay scared, America, and have a great weekend!

Read more at http://wonkette.com/561656/wingnuts-sure-oklahoma-beheading-suspect-proves-jihad-is-here#29DwxIXIcbS...