- The eBay Community

- Groups

- Fun & Social

- Community Spirit

- Diary of our stinking Govt.

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Diary of our stinking Govt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 20-04-2014 10:21 PM

As it's more than 100 days now, it has been suggested that a new thread was needed. The current govt has been breaking promises and telling lies at a rate so fast it's hard to keep up.![]()

This below is worrying, "independent" pffft, as if your own doctor is somehow what? biased, it's ridiculous. So far there is talk of only including people under a certain age 30-35, for now. Remember that if your injured in a car, injured at work or get ill, you too might need to go on the DSP. They have done a similar think in the UK with devastating consequences.

and this is the 2nd time recently where the Govt has referred to work as welfare???? So when you go to work tomorrow (or tuesday), just remember that's welfare.

http://www.abc.net.au/news/2014-04-20/disability-pensioners-may-be-reassessed-kevin-andrews/5400598

Independent doctors could be called in to reassess disability pensioners, Federal Government says

The Federal Government is considering using independent doctors to examine disability pensioners and assess whether they should continue to receive payments.

Currently family doctors provide reports supporting claims for the Disability Support Pension (DSP).

But Social Services Minister Kevin Andrews is considering a measure that would see independent doctors reassess eligibility.

"We are concerned that where people can work, the best form of welfare is work," Mr Andrews said at a press conference.

Diary of our stinking Govt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 30-10-2014 09:51 PM

national security? they just get weirder and weirder

Immigration won't reveal Ebola refugee ban advice because of 'national security'

Assistant minister says Senate order to table reasons for west-African refugee visa suspension has been refused to ‘limit risk’

The government has refused an order by the Senate to reveal the reasons behind its ban on accepting refugees from Ebola-stricken Liberia, Sierra Leone and Guinea, saying to disclose its advice would risk national security.

On Monday the immigration minister, Scott Morrison, announced that Australia’s humanitarian visa program for refugees from Ebola-affected west African countries would be suspended – including processing applications – until further notice.

Two days later the Senate ordered the government to table the advice it had relied on in making that decision, but on Thursday the assistant minister for immigration and border protection, Michaelia Cash, told the Senate the advice could not be revealed because it would “cause damage to national security”.

Diary of our stinking Govt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 30-10-2014 09:52 PM

NW: "MM12 I am still thinking about the medibank shares if I will apply... Not 100% sure yet on them....."

NW, this is a much anticipated government asset sale of Medibank which has been operating as a company for some time. I have ordered a block of shares from my stockbroker who said it will be scaled back by a factor of perhaps 90% because of the professional demand. Because of this I will also put in a bid (I pre purchased) for a public offering block of shares.

To keep some happy, here is the "Diary of our stinking Govt's" Medibank IPO .

| Record Date for Policyholder Offer and Employee Offer | 11.59 pm (AEST) 27 September 2014 |

| Retail Offer open | 28 October 2014 |

| Retail Offer closes and Applications due | by 11.59 pm (AEDT) 14 November 2014 |

| Final pricing and basis of allocation announced | 25 November 2014 |

| Expected commencement of trading on the ASX (on a conditional and deferred settlement basis) | 25 November 2014 |

| Settlement of the Offer | 28 November 2014 |

| Transfer of Shares under the Offer (trading on an unconditional and deferred settlement basis commences) | 1 December 2014 |

| Expected dispatch of transaction confirmation statements | 4 December 2014 |

| Shares expected to begin trading on a normal settlement basis | 5 December 2014 |

| First settlement date of all ASX trades | 10 December 2014 |

| Expected first dividend payment | September 2015 |

nɥºɾ

Diary of our stinking Govt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 30-10-2014 09:57 PM

@monman12 wrote:Gosh here I am about to quote from BIG's favourite red rag: "Independent Australia"!. Taken from an article on 20 May 2012

"Craig Thomson has been cruelly pre-judged by the Australian mass media."

Just a bit curious here but why do you keep calling Boris BIG after she has asked numerous times for you not to?

Is it so hard to respect the wishes of another poster?

Diary of our stinking Govt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 30-10-2014 10:03 PM

There is no reason to sell Medibank Private for short term gain. It's stupid to offload companies that return profit to the govt coffers every year.

Diary of our stinking Govt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 30-10-2014 10:04 PM

Diary of our stinking Govt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

30-10-2014 10:07 PM - edited 30-10-2014 10:07 PM

I have a feeling many other customers have done the same

Diary of our stinking Govt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 30-10-2014 10:16 PM

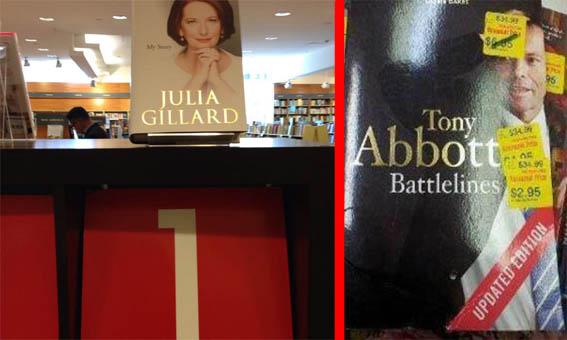

Julia Gillard, number 1 this week.

Diary of our stinking Govt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 30-10-2014 10:33 PM

@gleee58 wrote:There is no reason to sell Medibank Private for short term gain. It's stupid to offload companies that return profit to the govt coffers every year.

Watch them squeal when the premiums of their private health go up and the rebate disappears. Never hear the far righters banging on about the rebate being a hand out to the leaners and the corporate welfare bludgers.![]()

----------------------------------------------------------------------

Eroded almost into non-existence in the Fraser years, it was picked up and reborn as Medicare under Bob Hawke in 1984.

But there was another survivor from the Fraser years - Medibank Private, which started life as an uncomfortable ideological compromise for a Liberal government that disliked the state interventionism of the original Medibank but still wanted to keep a check on the private funds.

But it has also been accused in recent months of acting like a bully, using its market dominance to try to drive higher-cost hospitals - which are sometimes also the highest-quality providers - into offering lower-cost care.

Earlier this month the head of St Vincent's Health, Toby Hall, accused Medibank Private of putting profits before patients with implied threats to boycott hospitals that did not meet its demands.

"There is a huge risk when an insurance company starts telling people where to go" Mr Hall warned.

This week, as the nation farewelled Whitlam, the Abbott government placed Medibank Private on the auction block, lodging a prospectus that shows it hopes to reap in excess of $5 billion from the sale.

But others say the sale is not without its risks - both for investors, and for the broad principles of universality and equity of access that underpin Australia's health insurance system.

But others say the sale is not without its risks - both for investors, and for the broad principles of universality and equity of access that underpin Australia's health insurance system.

They fear the severing of Medibank Private's last links with government could unleash more aggressive tactics by it and other private health insurers, as they compete to drive down the costs of healthcare and maximise returns to shareholders, instead of keeping policy-holders' interests paramount.

Menadue worries that any growth in the power of private funds "undermines Medicare and takes us down the US path of inefficient, and expensive, private healthcare insurance."

John Evered, who ran Medibank Private from 1996 to 1999, says "we may well be on the brink of a proliferation of health funds operating for profit, with stakeholders who are not health fund members".

He fears the organisation's transformation into a listed company will bring "upward pressures on private health insurance premiums from very significantly higher executive salary packages and dividends to shareholders".

Diary of our stinking Govt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 30-10-2014 10:34 PM

bernardis book is 67 cents.

Diary of our stinking Govt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 30-10-2014 11:01 PM

Hockey's was buried in the back bookshelves in store I went to.. My Story by Julia was prominently placed on the Top 10 stand.