- The eBay Community

- Groups

- Fun & Social

- Community Spirit

- Re: Diary of our stinking Govt.

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Diary of our stinking Govt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 20-04-2014 10:21 PM

As it's more than 100 days now, it has been suggested that a new thread was needed. The current govt has been breaking promises and telling lies at a rate so fast it's hard to keep up.![]()

This below is worrying, "independent" pffft, as if your own doctor is somehow what? biased, it's ridiculous. So far there is talk of only including people under a certain age 30-35, for now. Remember that if your injured in a car, injured at work or get ill, you too might need to go on the DSP. They have done a similar think in the UK with devastating consequences.

and this is the 2nd time recently where the Govt has referred to work as welfare???? So when you go to work tomorrow (or tuesday), just remember that's welfare.

http://www.abc.net.au/news/2014-04-20/disability-pensioners-may-be-reassessed-kevin-andrews/5400598

Independent doctors could be called in to reassess disability pensioners, Federal Government says

The Federal Government is considering using independent doctors to examine disability pensioners and assess whether they should continue to receive payments.

Currently family doctors provide reports supporting claims for the Disability Support Pension (DSP).

But Social Services Minister Kevin Andrews is considering a measure that would see independent doctors reassess eligibility.

"We are concerned that where people can work, the best form of welfare is work," Mr Andrews said at a press conference.

Re: Diary of our stinking Govt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 06-02-2015 02:54 PM

@polksaladallie wrote:

@gleee58 wrote:

@donnashuggy wrote:So what is your prediction glee? I think Malcolm is playing it cool, the more he says he isn't interested the more they will want him.

They must know that Morrisson doesn't have any appeal to the public, it is not what THEY want, they have to think what the public will swallow.

Mmm, don't know yet. I suspect it's all a game and a distraction until abbott can find another distraction like a good old war or terrorist attack somewhere.

Oh look ! Here comes Tampa Mark 2

or some equivalent saviour.

Excellent, this time we can sail them back on the boat.

Re: Diary of our stinking Govt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 06-02-2015 02:55 PM

@am*3 wrote:Yes, only target certain posters.. others can get away with 100 furphies a day!

Never acknowledges or apologises for false accusations either.

Took a lesson from you and glee and Boris then.

Re: Diary of our stinking Govt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 06-02-2015 03:05 PM

![]()

![]()

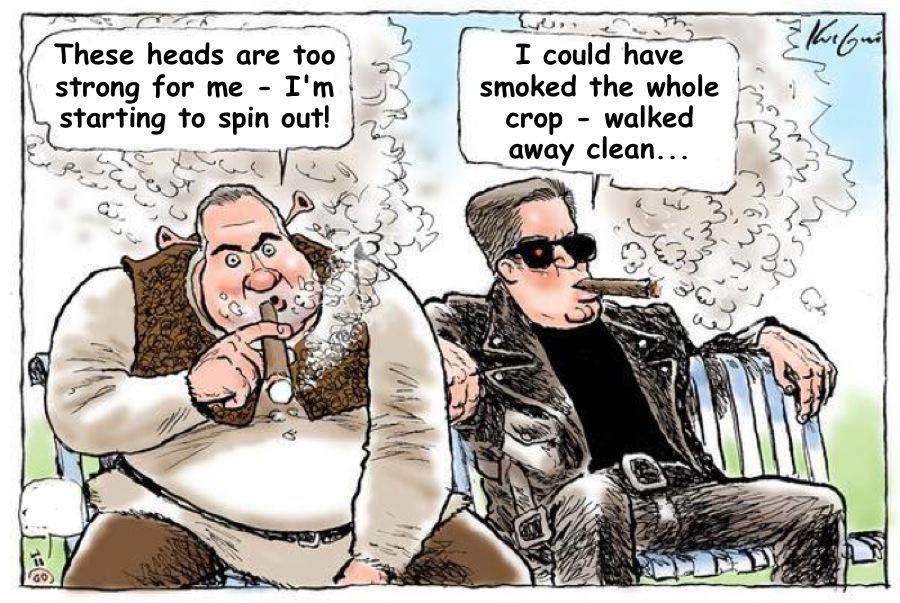

![]() the bolter is having a whine because he reckons the abbott hasn't been right wing enough, where does this fool live, I'm starting to think he lives abroad and flys in for his bog show.

the bolter is having a whine because he reckons the abbott hasn't been right wing enough, where does this fool live, I'm starting to think he lives abroad and flys in for his bog show.

Re: Diary of our stinking Govt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 06-02-2015 03:09 PM

@boris1gary wrote:

the bolter is having a whine because he reckons the abbott hasn't been right wing enough, where does this fool live, I'm starting to think he lives abroad and flys in for his bog show.

He lives under a bridge

Re: Diary of our stinking Govt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 06-02-2015 03:14 PM

@boris1gary wrote:

the bolter is having a whine because he reckons the abbott hasn't been right wing enough, where does this fool live, I'm starting to think he lives abroad and flys in for his bog show.

Flakey, backed a loser....

Re: Diary of our stinking Govt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 06-02-2015 03:18 PM

Re: Diary of our stinking Govt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 06-02-2015 03:19 PM

Re: Diary of our stinking Govt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 06-02-2015 03:21 PM

No comment yet from mm12, re corporate tax take vs corporate tax rate..

I like to research before I post C&Ps. A3 or I might post something like this:

" He (Abbott) hasn't been in the area he was in the last couple of days for 10 years.." !!!!!!!!!!

So please, what do you understand by tax "take" A3 ?

"The Business Council of Australia and the Australian Chamber of Commerce and Industry said the nation’s corporate tax take was already the second highest in the OECD." second highest ????

OECD Corporate Income Tax Rates

Australia 30%

Japan 37%

Belgium 34%

USA 39.1%

France 34.4%

Portugal 31.5%

Germany 30.1%

The weighted average (by GDP) of OECD countries is 32.5%

The original article (not the Australian) Business Council of Australia chief Jennifer Westacott includes:

Corporate tax reform was more important than ever given greater global competition. “Japan and Spain recently announced corporate tax cuts to boost investment and growth,” Ms Westacott said. “If we look back a decade, our corporate tax rate of 30 per cent was a little above the averages of the OECD and our competitors in the Asia-Pacific region – which were about 29 and 28 per cent, respectively. Since then, these averages have fallen around 5 percentage points while we have stood still.”

i.e. she is referring to our 30% corporate tax rate, or take.

Even this statement does not stand up to scrutiny (as reported) because the figures above, note the OECD weighted average are certainly not as she suggests around 24% -23% using her (minus 5%),

I would assert that the her terminology take/rate mean the same thing, considering she is arguing the case for a reduction in company tax and "take" means government "take" from business, or tax rate imposed by government.

However, I will accept figures and there are reams of them from a reliable source.

I will keep my references for later, and let you research (sorry).

Re: Diary of our stinking Govt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 06-02-2015 03:23 PM

Is everyone watching CH 24?

Make or break pleading is what I expect.

Re: Diary of our stinking Govt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 06-02-2015 03:31 PM

What a coward.