- The eBay Community

- Discussion Boards

- Buying & Selling

- Selling

- Re: ATO Request for Data

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 15-05-2015 11:11 AM

This is the first time we have received one of these since we have been trading on eBay.

Anyone else?

Solved! Go to Solution.

Re: ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 15-05-2015 11:40 AM

Yes got one... my first time.... I wonder if there will be some worried people?

Re: ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 15-05-2015 11:41 AM

@harley_babes_hoard wrote:

well I assume it is happening now because the May deadline has now past for reporting the 2013-2014 income

If you use a registered accountant you have untill June 5th to lodge your taxation details for 2013-2014 financial year, so still time if people have not done so.

Re: ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

15-05-2015 11:44 AM - edited 15-05-2015 11:46 AM

my accountant said May 15th

The due date of your tax return depends on how you lodge, and whether you have any unlodged tax returns.

The normal (early) due date is 31 October 2014. This applies to anybody who lodges their own tax return.

If you lodge through a registered tax agent, you get an extension to the due date. The extension is usually until 15 May 2015, but an earlier date of 31 March 2015 applies to a small number high income taxpayers

Re: ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 15-05-2015 11:53 AM

I still havnt done mine yet and the accountant has advised June 5th, so I hope shes right. Its possible the date is different depending on the class of business you run. Maybe she knows a few loopholes to extend the date, she is a specialist in small to medium sized business and fairly highly qualified. Some of the chain groups that have offices everywhere dont offer the same expertise that the specialists can provide..

Re: ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 15-05-2015 11:55 AM

Hi

I'm a bit lost. I too received this email and am not sure how to proceed.

I sell things on ebay as a hobby. I don't have a business or a store. What should I be doing? How can I ensure I am doing the right thing?

Thanks in advance

Re: ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 15-05-2015 11:57 AM

Yes its 15th May deadline as I understand it too. ie today.

So if anyone has not declared last tax years income and they are on the ebay report list then I would expect to get a please explain letter from the ATO shortly.

Re: ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 15-05-2015 12:01 PM

You need to declare all sources of income to the ATO each and every tax year. No matter how small. Regardless of shop / business owner or hobbyist or whatever.

Then its up to your tax accountant to figure out how much tax you are due to pay, if any.

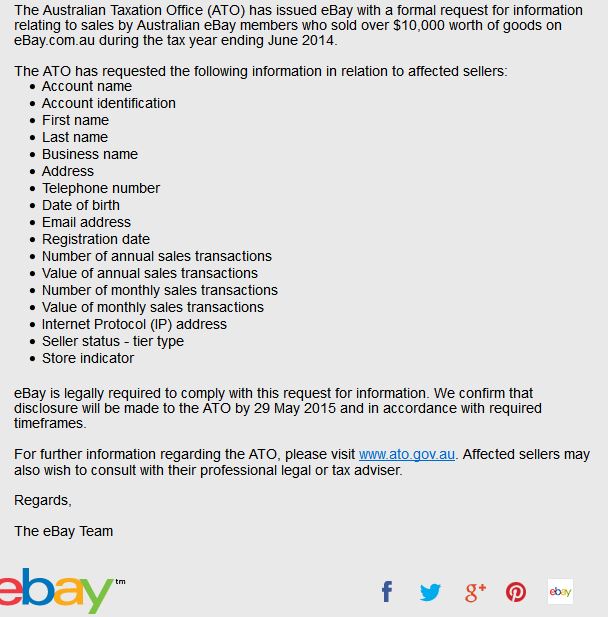

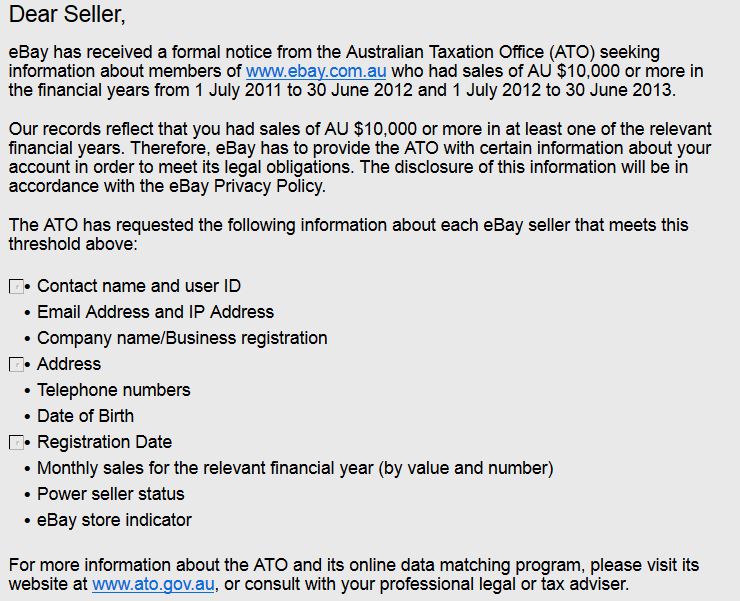

If you have received one of these ebay emails then I suspect that your ebay sales must have crossed the $10K threshold in the tax year ending 30th June 2014.

If you did not declare your ebay income in that tax year then I would be expecting a please explain letter from the ATO sometime soon.

Re: ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 15-05-2015 12:03 PM

@harley_babes_hoard wrote:my accountant said May 15th

The due date of your tax return depends on how you lodge, and whether you have any unlodged tax returns.

The normal (early) due date is 31 October 2014. This applies to anybody who lodges their own tax return.

If you lodge through a registered tax agent, you get an extension to the due date. The extension is usually until 15 May 2015, but an earlier date of 31 March 2015 applies to a small number high income taxpayers

I just phoned the accountant and she advised the 15th of May is the standard date, but she was able to lodge a few weeks later in certain circumstances so it sounds like it depends on your accountant.

Re: ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 15-05-2015 12:05 PM

The amount hasn't changed.

It was also $10,00 in last year's letter and it applied to turnover from July 2011.

Re: ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 15-05-2015 12:05 PM

That would be why these messages are being sent out today as it is the gazetted final day for lodgement.