Ebays latest agreement update

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 29-05-2018 11:48 AM

Wont affect me because I dont buy outside Australia but I cant wait to read the inevitable messages from buyers and sellers about the new GST collection announcement .

The bit that really made me laugh was this bit about location mis representation....

We take item location misrepresentation seriously on eBay. As part of eBay’s Selling practices policy, we have deployed technology to prevent and detect violations across listings and transactions. Sellers found in violation of this policy are may be subject to listing removal, warnings, suspensions by eBay, and may be at risk of compliance action by the Australian Tax Office.

Ebays latest agreement update

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 29-05-2018 12:37 PM

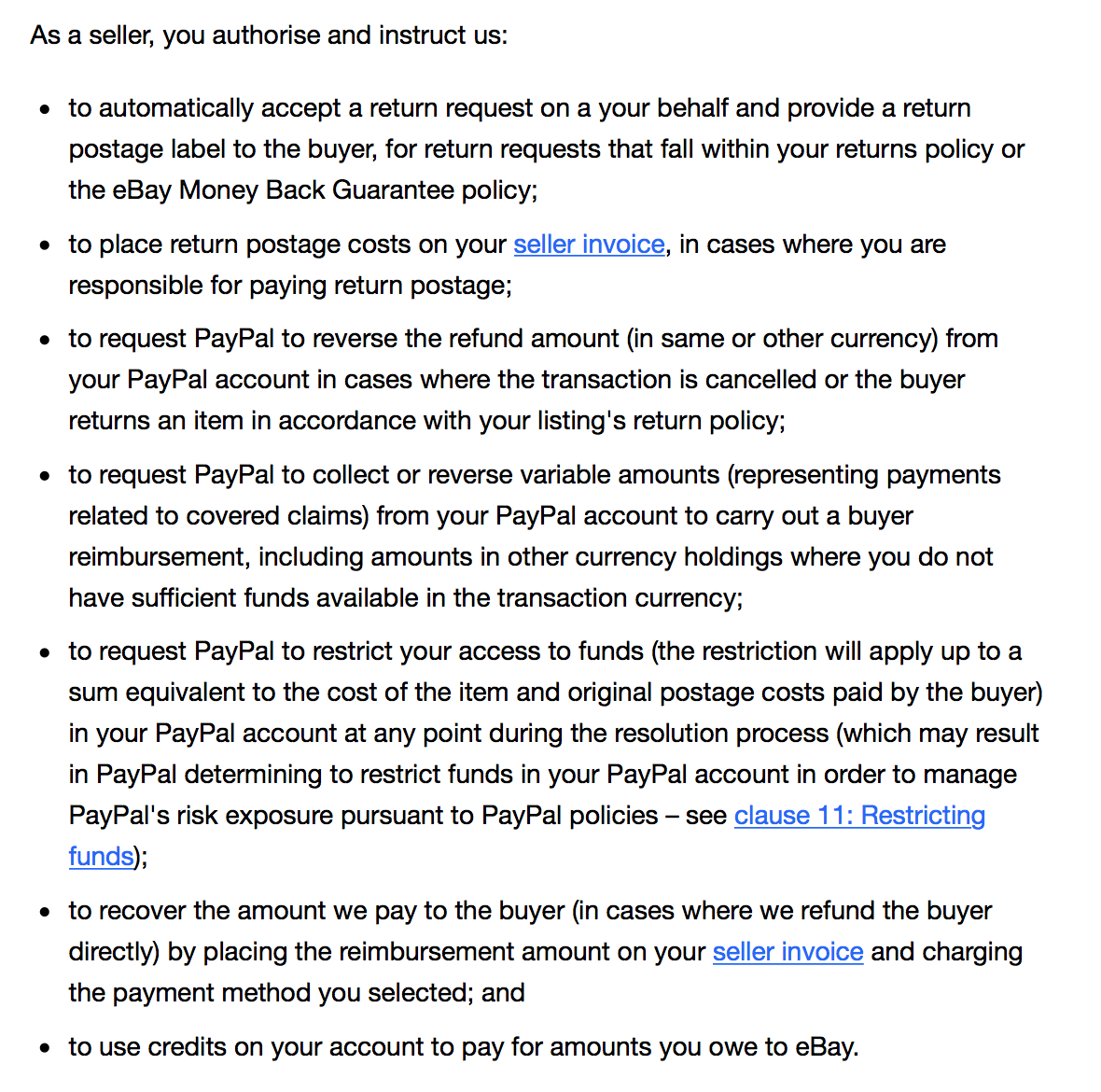

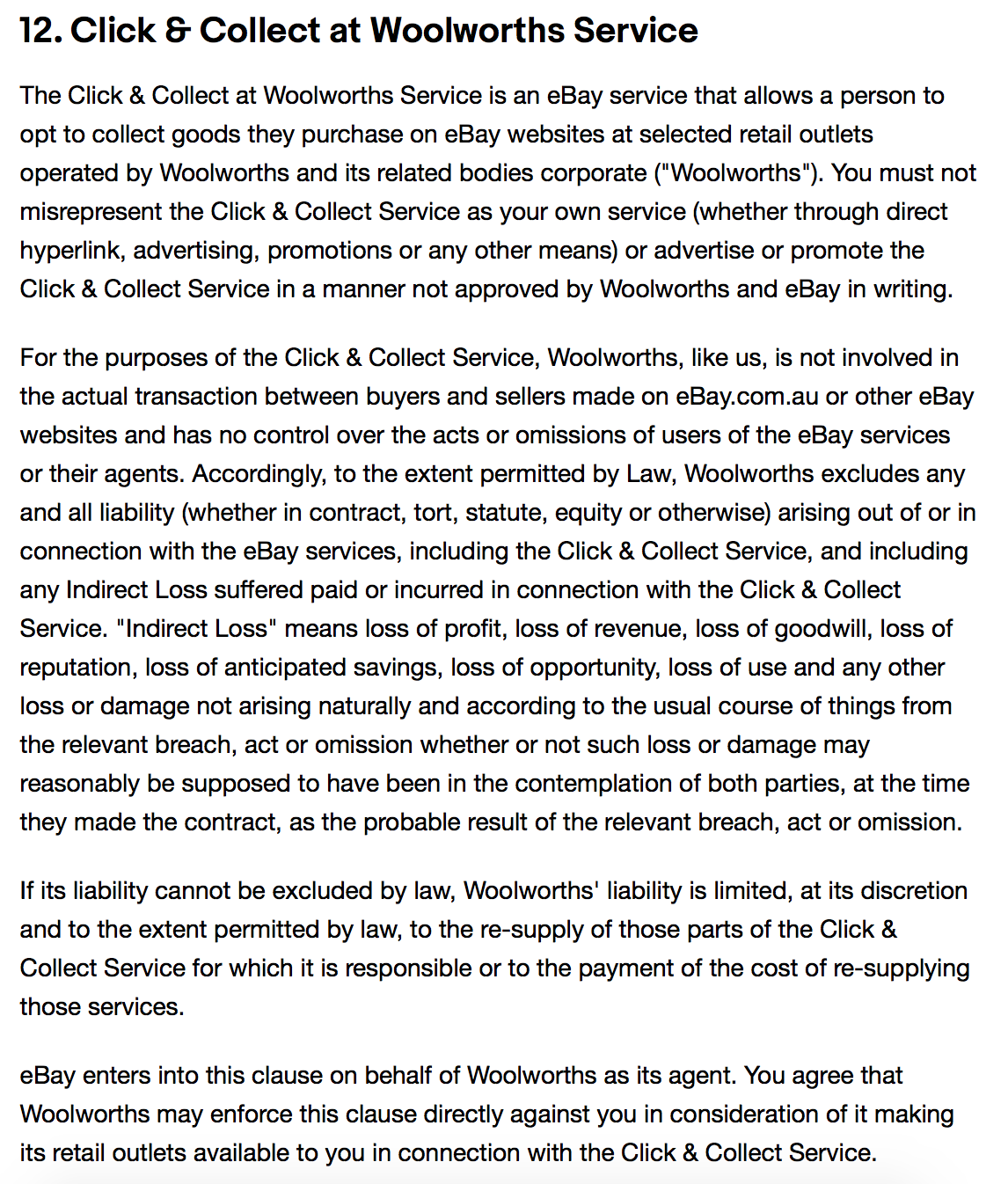

also, it is interesting to note changes to the user agreement in section 10 and 12 - which it doesn't specify what they are in the email.. but when looking at the agreement it says the following (that being said, i've never read these clauses in full, so don't know what is new and what is not)..

but in summary - section 10 says ebay can refund for any reason and withdraw the money from your paypal account as well as the return postage the buyer pays on returns.. and section 12 is in regards to click & collect stating that woolworths has no liability for lost or damaged items whilst under their control..

Ebays latest agreement update

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 29-05-2018 12:39 PM

I can't imagine why there would be messages about the collection of the GST.....it is quite clear what is going to happen.

Sellers don't have to do anything and buyers just have to pay the invoice that they are sent.

Ebays latest agreement update

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

29-05-2018 12:48 PM - edited 29-05-2018 12:48 PM

From eBay -

Starting 1 July 2018, we will be collecting Goods and Services Tax (GST) from buyers on all imports with an order value less than 1,000 AUD. Sellers don't need to do anything.

If you have products located outside Australia, your prices may appear 10% higher to buyers than before if their ship-to location delivery address is in Australia. If you have any questions or require more information, please head to the Australian Tax Office.

Ebays latest agreement update

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 29-05-2018 01:40 PM

@lyndal1838 wrote:I can't imagine why there would be messages about the collection of the GST.....it is quite clear what is going to happen.

Sellers don't have to do anything and buyers just have to pay the invoice that they are sent.

Yea but you and I both know you could put it in plain language that even a baby could understand then make a big flashing neon sign out of it and you would still get the folks that go - Oh no ebays charging me GST .... its bound to happen!

Reading the above about sections 10 and 12 ....hmm maybe I was not far off with my idea that the recent defect notices some of us got IS actually ebay playing with automatic defect ratings.

Ebays latest agreement update

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 29-05-2018 01:51 PM

But why would it be remarkable for ebay to charge GST.....it is being done on behalf of the seller. Every B & M store that you shop in adds GST which goes to the ATO.

Ebays latest agreement update

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

29-05-2018 02:42 PM - edited 29-05-2018 02:45 PM

@outback_blends wrote:Wont affect me because I dont buy outside Australia but I cant wait to read the inevitable messages from buyers and sellers about the new GST collection announcement .

The bit that really made me laugh was this bit about location mis representation....

We take item location misrepresentation seriously on eBay. As part of eBay’s Selling practices policy, we have deployed technology to prevent and detect violations across listings and transactions. Sellers found in violation of this policy are may be subject to listing removal, warnings, suspensions by eBay, and may be at risk of compliance action by the Australian Tax Office.

eBay now have skin in the game and potentially something to lose if they should have collected GST on a transaction, but didn't because the seller lied about the item location.

If they are deemed liable for the GST that wasn't collected, I can see them suddenly taking the issue much more seriously than they have up til now.

@lm - some of those terms have been around for a while, some have been reworded or introduced; they changed the user agreement so that eBay is authorised to debit PayPal accounts in relation to MBG cases, including return postage costs. Automated returns is newer, so some of the new clauses is in relation to that (not impressed with automated return system at all, but that's a rant for another day).

The Woolworths clause is actually stating they will take liability for any parts of the service they are directly responsible for (in other words,they'll meet their legal requirements, but they won't compensate buyers in any way for items not as described, or something that is a direct result of the seller's / eBay's actions, nor any consequential loss related to the products or service, which is pretty standard.

PS - Anyone had a gander at eBay Prime Plus? $49 a year and buyers get free post plus free returns (eBay pays for the postage costs on their behalf if the seller has a P&H charge, interestingly). According to the listed criteria, I could potentially qualify for this. Though probably won't with a 2 day handling time.

Ebays latest agreement update

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 29-05-2018 02:53 PM

@kopenhagen5 wrote:From eBay -

Starting 1 July 2018, we will be collecting Goods and Services Tax (GST) from buyers on all imports with an order value less than 1,000 AUD. Sellers don't need to do anything.

If you have products located outside Australia, your prices may appear 10% higher to buyers than before if their ship-to location delivery address is in Australia. If you have any questions or require more information, please head to the Australian Tax Office.

Sigh. There are still a few expensive rare collectable items I will never find in Oz that are going to be far worse to justify the cost if another 10% is added. I might as well give up the chase. The cost of postage had almost done it...the GST may be the death knell.

Perhaps eBay might like to have another promotional discount for overseas sales from 01 Jul to ease us into the pain. 🙂

Blasted government and blinkered Oz shop owners. None of this is going to get me anywhere near B&M stores. They don't have what I want.

Ebays latest agreement update

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 29-05-2018 03:01 PM

I can't believe any seller will qualify for ebay Plus if they are not offering so called free post.

Ebays latest agreement update

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 29-05-2018 03:58 PM