- The eBay Community

- Discussion Boards

- Buying & Selling

- Selling

- International buyer not paying VAT

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

International buyer not paying VAT

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 30-06-2021 05:58 PM

I sold a phone to a buyer in Spain and the item is currently in Spanish customs and it has been stuck there for two weeks. The tracking update says they are awaiting documentation from the recipient, most likely a payment of the VAT. The buyer was unaware of the tax and is refusing to pay. If they never pay, and the item is returned back to me, do I have to refund the buyer the shipping cost given that this is completely the buyer's fault? If I did, I would be down $44 overall... Anyone have experience with this? I guess I'm never going to sell anything internationally anymore in the future.

International buyer not paying VAT

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

30-06-2021 08:10 PM - edited 30-06-2021 08:11 PM

Buyers are supposed to do their due diligence and are 100% responsible for the payment of Customs/Duties etc. You can send them a copy of the Terms and Conditions:

Import duties, taxes, and charges are NOT included in the item price or shipping cost. These charges are the buyer's responsibility. Please check with your country's customs office to determine what these additional costs might be prior to buying!

That being said, many buyers "claim" not to know about these taxes, in the hope that they can make a case against you.

After a certain number of days, the item will hopefully be returned to you (for example I think the UK is after 28 days). I wouldn't necessarily communicate any further, other than to say that if the item is returned, you will only refund the purchase price, not the postage as this has been used up. Or, you could not communicate anything at all.

Unfortunately, Spain is one of the countries I will never send to, as many of the Southern European countries have a bad reputation for theft and items going "missing" as well as non-delivery.

Would the phone even work in Spain? Sending electronics overseas is somewhat fraught with danger IMHO.

The whole thing seems pretty suss and I think the buyer knows exactly what they are doing. What is their feedback left for other sellers like?

International buyer not paying VAT

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

30-06-2021 08:56 PM - edited 30-06-2021 08:57 PM

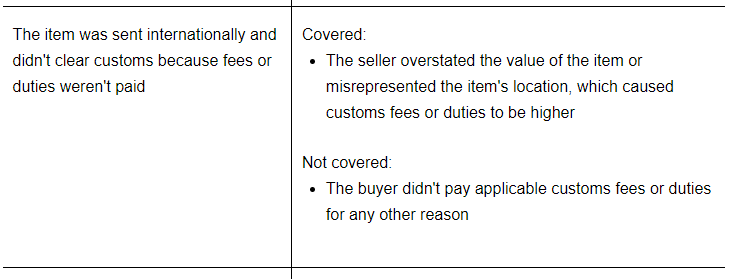

The buyer is not eligible for protection under the MBG if they refuse to pay customs / import costs, as long as the item value was accurately declared - they may be able to open a case, and if they do, contact eBay CS immediately, ensure you are talking to a person in the right (MBG) department, and go through the details to point out the buyer is not covered. The good news is, after tomorrow, this will rarely be an issue again, for orders under EUR150 anyway, as eBay will start collecting VAT up front from EU buyers.

International buyer not paying VAT

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 30-06-2021 09:26 PM

That's good news Digi - they've started doing this on Etsy recently too. I believe there is a special code now you have to add to the parcel which indicates that taxes have been collected. This will be a win for sellers and take away the stress of some of those international sales, especially for higher priced items.

International buyer not paying VAT

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 30-06-2021 09:59 PM

I sent some items to Spain a few years back and their customs are very slow at processing packages as they require invoices from the buyer stating the value of the item. I sent the item express and it sat for around a month in customs and it was made in Spain. The best way to send items to countries like these is to use DHL or similar which collect customs up front and then bypass this process.

International buyer not paying VAT

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 30-06-2021 10:07 PM

When I send parcels to certain countries such as Germany, I always put a copy of the invoice in a ziplock bag taped down on 3 sides, on the outside of the package. This way Customs have an easier time of evaluating the contents.

International buyer not paying VAT

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 30-06-2021 10:22 PM

Got a feeling, there is going to be a lot of electronics getting confiscated by EU Customs departments, Re CE marks, and Authorised Economic Operator requirements. I for one, won't be sending any electronics to Europe until I can understand how this all works, especially for items sold for parts or repair and or just parts.

International buyer not paying VAT

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

30-06-2021 11:04 PM - edited 30-06-2021 11:06 PM

There should be an IOSS number provided by ebay for EU orders after tomorrow, which is functionally similar to an ABN and will be how customs in EU countries will determine if VAT has already been collected or not (this will be essential, as unlike other similar systems, where it's assumed tax was either already collected or not applicable and just clear the package, customs will charge it to the buyer as well as collection fees, so you definitely need to make sure the buyer doesn't get charged twice - Aus Post told me to put it in the "importer's reference" field as they are not changing the label to include an IOSS number field).

HS codes and accurate product descriptions are now essentially mandatory too - vague descriptions are likely to cause delays in customs processing.

Selling to the EU is definitely getting more complicated, especially if the safety of your product(s) could be of any concern to the consumer (eg all the new regulations surrounding selling children's toys into the EU, requiring you to get a rep over there who can distribute product safety info as well as all the seller's personal contact info etc) - I disabled shipping for all EU countries on my website 6 months ago because of all the impending tax stuff (I will still sell there via third party platforms). My categories haven't really been hit by stringent regulations (yet) but I do sometimes get asked if I can supply test reports to ensure my items comply with EU regulations (they do, I just can't afford spending the money to get an independent test done for 600+ products to prove it).