- The eBay Community

- Discussion Boards

- Buying & Selling

- Buying

- import charges

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

import charges

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 07-07-2018 01:24 AM

Hello All, Have noticed lately there are import charges on international purchases. Payable in the currency of the country you are buying from. This is in addition to the Global shipping program charges.

Australia does not have import charges for items under 1000$. Have been having to pay these charges for items under

200$. Thought it was the GST under the guise of Import Charges. But this works out far more than the 10% GST Australia now has on international purchases.

Vouchers/ coupons are also not available for the length of time stated. Had one that was supposed to be available until the 8th of July.

It disappeared today, the 6th July.

import charges

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

24-06-2019 09:09 AM - edited 24-06-2019 09:10 AM

@Anonymous wrote:One point most, if not all, of the respondents to the initial email appear to be missing is that GST import charges for items less than AU$1000 generally are over 10%, and often well over 10%. Anyway, that's been my experience. I recently bought an item from the US, and the import charges ($12.90) for the item and shipping ($80.72 all up) were just under 16%. I was lead to believe it was set at exactly 10%. Why the variation? This has happened to me many, many time before also.

you are confusing GST with Import Charges . . . they are two different things.

When buying from overseas you pay 10% GST on the cost of the item and shipping.

When buying from an overseas seller who uses the GSP (Pitney Bowes) shipping option then they charge you a fee to collect the GST and process all the paperwork like customs declarations etc. On top of this, they charge GST on the fee they charge.

Then, they bundle together the GST, GSP shipping and their fees and they call that an Import Charge.

On your item you paid $8.07 GST and $4:83 in other fees/charges associated with use of the GSP.

import charges

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 24-06-2019 09:21 AM

Thank you for that insight.

import charges

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 12-07-2019 02:23 PM

@k1ooo-slr-sales wrote:

you are confusing GST with Import Charges . . . they are two different things.

When buying from overseas you pay 10% GST on the cost of the item and shipping.

When buying from an overseas seller who uses the GSP (Pitney Bowes) shipping option then they charge you a fee to collect the GST and process all the paperwork like customs declarations etc. On top of this, they charge GST on the fee they charge.

Then, they bundle together the GST, GSP shipping and their fees and they call that an Import Charge.

On your item you paid $8.07 GST and $4:83 in other fees/charges associated with use of the GSP.

------------------------------------------------------------------------------------------------------------------------------------------------------------------------

I'm still confused.

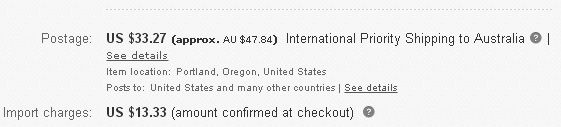

I am looking to buy an item from the US (estimated cost is about AU$80) that comes in a box that measures possibly 25 x 20 x 5cm, and weighs under 500g. The seller uses the GSP. This is what shows re postage.

I have had a friend in the US check the cost of sending it to her , and it is US$14. If she then sends it on to me, would I still have to pay the import charge?

import charges

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 12-07-2019 09:38 PM

Neither I nor anyone else can answer that; there is a possibility that doing that could be seen by the ATO as tax evasion.

You should probably contact the ATO to clarify a situation of this sort.

import charges

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 12-07-2019 11:10 PM

import charges

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 12-07-2019 11:20 PM

import charges

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 13-07-2019 08:34 PM

There's a big difference between tax avoidance and tax evasion. Tax avoidance is doing as much as you can to legally reduce your tax.

If anyone wants to get something posted to a friend overseas and then get them to repackage it and post it to 'avoid' paying GST, I see no problem with that. It'd have to be a very expensive item to be worth paying two lots of postage just to avoid paying GST, but doing it to avoid paying high postage through the GSP could make it very worthwhile.

I'll bet most of you would use a friend to forward your items rather than use a forwarding service if you had a friend living in the country you wanted to buy from. It's no different to getting them to buy it for you and then you buying from them - absolutely nothing illegal in that.

import charges

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 23-10-2019 07:31 AM

GST came into effect 1/7/18. The debate is about "import charges" that appear on many overseas listings here in Australia

import charges

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 23-10-2019 12:16 PM

The Import Charges on some overseas listings would be the listings using the GSP as the shipping service.

The GSP charges fees for their services anf there is GST to be paid on those fees. They also collect the GST on the entire transaction.

These are all lumped together as Import Charges for the purposes of listing.

import charges

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 12-01-2020 04:18 PM

I buy a lot on ebay from all over the world. Would somebody please enlighten me about why most seller do not levy an import charge?

I am reminded of an old scam on ebay in which sellers levied an unavoidable insurance charge. I think this was mostly sellers in China. Maybe no similarity really, but I've been wondering if I can trust a seller who charges postage as well as an import charge. Sometimes this trust doesn't matter, but with some items I buy it does. I just want to understand and also not to distrust sellers who may be honourable, And also sometimes I just don't buy with that import chage sitting there & maybe I am doing myself out of a good product? This latter case happened to me most recently when I wanted to buy some CDs from the USA but they had an import chage as well. I was surprised as I buy CDs worldwide with no import chages and cheaply.

🡄 Undesirable outcome...

🡄 Undesirable outcome...