- The eBay Community

- Discussion Boards

- Buying & Selling

- Selling

- Re: ATO Request for Data

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 15-05-2015 11:11 AM

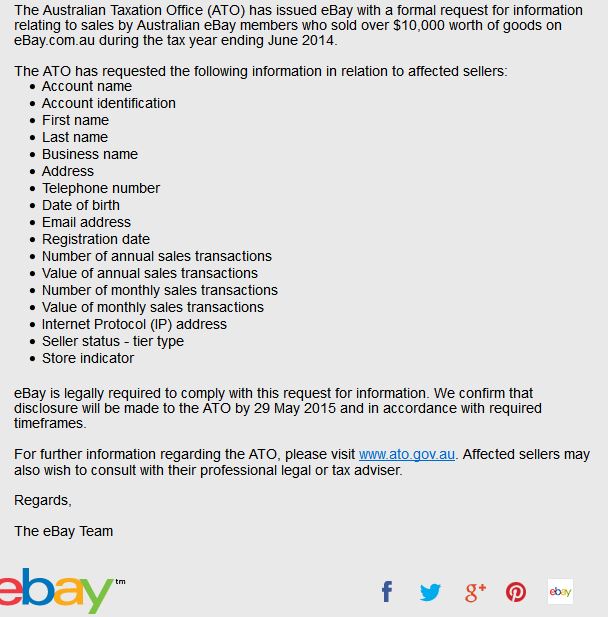

This is the first time we have received one of these since we have been trading on eBay.

Anyone else?

Solved! Go to Solution.

Re: ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 24-10-2015 11:49 AM

its simple on your june invoice you total up until the end of june and start next years return from the 1 st of july and keep it

Re: ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 24-10-2015 12:08 PM

I just download the Paid and Posted report in CSV format at the end of each calendar month.

Then I store that away on my local hard drive.

Its simple and only takes a few minutes to do that each month and you have all the tax/sales info you need (and more) in those reports.

Part of your bookkeeping tasks if you are an online trader.

On advice from my tax accountant I have setup up another spreadsheet that keeps track of all my income and business expenses so at the end of the tax year its a very simple task for him to prepare my tax returns. Because his task is easier he charges me less to do it too.

If you are over the $10K threshold ebay do indeed report your sales figures to the ATO. If ATO are then unable to match this up with a tax return from you then you will surely get a "please explain" letter from the ATO.

In any case, ALL income (from dollar ZERO) must be reported to the ATO (even under $10K) but it's especially important if you are over this $10K threshold as the ATO (and therefore also CentreLink) will know about you. CentreLink, in particular, take a very dim view if you are drawing benefits that are subject to income and you have not declared the income to them or the ATO.

Re: ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 24-10-2015 06:44 PM

My apologies, I have listed it elsewhere.

It's a formal request (not an order to comply). eBay don't have do do it, it's not a formal order to comply.

Every email I've sent to eBay in reply has remained unanswered.

This is the first time in 10 years or so that I've ever received this.

However, I CAN tell you that there are certain items on that list that are against Australian privacy Laws.

I know it's illegal to store an IP address.

D.O.B. ? I don't ever telling this Company that.

So, I bought my stock with MY money that I've already been taxed on?

There's a clause in your tax return that asks if you received income from any other source. That means (for some) that the few lousy bucks you made for Grandma's Spoons HAS to go onto your tax reutrn, increasing the amount of taxable income so the Taxman can have his share of that too?

No! Enough. Complain. This is NOT right!

If I had your IP address, I can find the house you live in.

D.K. - Senior Software Project Manager

Re: ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 24-10-2015 08:17 PM

Ebay most certainly do have to comply.

I am quite sure they don't want any trouble with Australian authorities and a "request" from the ATO is as good as a court order.

It really does not matter how you paid for your goods....when you do your tax return the taxable income is what is left from the sale price after deductions for item cost, postage cost and all the other legal deductions. In some cases you may not have made enough profit to have to pay tax.

As for selling Grandma's spoons....that is a private sale ans not taxable anyway. It is only when you go out and buy items to sell on ebay that you are running a business and need to declare it.

There would be people who have been reported to the ATO when they have sold one large ticket item like a car but it would be non taxable when the seller does their tax as it was a private sale....the car was not bought with the intention of selling at a profit.

Before you waste any more time and energy complaining about ebay it may be worth actually reading a bit more about ebay and learning what is business selling and what is private selling....what you will have to pay tax on and what you won't have to pay tax on.

Re: ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

24-10-2015 11:13 PM - edited 24-10-2015 11:14 PM

Btw, I checked the Australian Privacy laws and ebay is required to provide me with the information they are giving to the ATO, if I request them to do so. Otherwise how can ANY of you be 100% sure that eBay is giving correct info to the ATO? After all, ebay suffers bugs, glitches and mistakes...these forums are full of such tales....

Australian Privacy Principle 12 — access to personal information

Access

12.1 If an APP entity holds personal information about an individual, the entity must, on request by the individual, give the individual access to the information.

Re: ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 25-10-2015 12:04 AM

As long as Ebay is paying there tax to the ATO they won't have problem.![]()

I been getting them for the last 4 / 5 years. ![]()

Re: ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 25-10-2015 01:04 AM

@asianantiquemaps wrote:Btw, I checked the Australian Privacy laws and ebay is required to provide me with the information they are giving to the ATO, if I request them to do so. Otherwise how can ANY of you be 100% sure that eBay is giving correct info to the ATO? After all, ebay suffers bugs, glitches and mistakes...these forums are full of such tales....

Australian Privacy Principle 12 — access to personal information

Access

12.1 If an APP entity holds personal information about an individual, the entity must, on request by the individual, give the individual access to the information.

I am pretty sure that I read of a few sellers who did formally ask ebay for a copy of the information that was given to the ATO. As far as I am aware they got it.

And it really does not matter all that much if the information is not 100% correct.....ebay has no idea if your sales were private sales or business sales, how much you paid for the items you are selling or indeed if you paid for them. They have no idea of your deductable expenses. The information is simply a starting point for the ATO to start looking at compliance issues.

Re: ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 25-10-2015 07:31 AM

Thanks Lyndal. I agree with you the info is only part of what I need. However, this info is important to me because:

1. I didn't think I'd hit the threshold for 2014/15 financial year, so I wasn't keeping copies of all ebay monthly statements. I did actually subscribe to getting the monthly sales reports, but didn't have all of them. Sometimes I even get error messages saying that I haven't subscribed to them at all, even though I know I have.

2. Although other ebay members say they download and keep a copy of their monthly sales reports, I don't think the onus should be on sellers having to do this since ebay is a global marketing/IT company that could very easily create a dropdown box where you could choose yearly sales figures, not just monthly ones from seller dashboard. eBay have this info anyway as they will be sending it to ATO, so why not just allow sellers to access it. It's not too much to ask for given we pay 10-12% fees to ebay and ebay should be automating these simple processes rather than sellers having to do it monthly.

As another seller pointed out, it's easier to get 2 years data on what you purchased from eBay than what you've sold.

Re: ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 25-10-2015 08:26 AM

hi you said you dont think you met the threshold [ theres no threshold] your income from $1 onwards is takings that must be put in your tax return ifn you are buying and selling , which is income , and makes part of your yearly earnings,

the $10.000 which was $20.000 a couple of years ago , is what the ato wants from ebay otherwise ebay would have to send it for everyone from $1 sales for the year.

if ebay sent it to the ato this year , and then next year they dont because your sales were only $9000 , and there is nothing in next years tax form from income from ebay the ato can ask for your sales that year.

Re: ATO Request for Data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 25-10-2015 11:06 AM

@lyndal1838 wrote:

@ironiton wrote:Ebay are quite happy to help with the ATO's requests,show us yours and we'll let you off paying full cororate taxation.Hand on **bleep** and the little guy wipes it up.

Do grow up!!

Ebay has no option but to comply with the ATO's requests for information.....it is the law.

And nobody is letting ebay off paying full corporate tax....they are not required to pay anything until the Australian Government changes the law.

Do you really think there is a conspiracy between the ebay and the ATO....maybe you need to find a seller of tinfoil hats.....you need one.

Firstly, This is inappropriate content. "Do grow up" is completely off topic.

Next, this is a REQUEST not an order to comply.