- The eBay Community

- Discussion Boards

- Buying & Selling

- Selling

- When does eBay report our earnings to the ATO?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

When does eBay report our earnings to the ATO?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 21-01-2019 10:30 PM

That's fine, but I can't find anywhere that specifies what the amount is. I thought it was $10,000 but then I heard it was $20,000.

Also, do they report your gross earnings, before things like postage costs and fees are deducted? I assume they do and then you're responsible for declaring the postage, stock costs and fees as tax deductions?

Thank you! (I only opened my store in late July)

When does eBay report our earnings to the ATO?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 21-01-2019 10:39 PM

When does eBay report our earnings to the ATO?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 21-01-2019 11:26 PM

When does eBay report our earnings to the ATO?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 21-01-2019 11:43 PM

When does eBay report our earnings to the ATO?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

22-01-2019 12:19 AM - edited 22-01-2019 12:20 AM

@kitty-kat-kollection wrote:

Meaning, I heard that once you earn over a certain amount, eBay automatically reports your income to the ATO.

That's fine, but I can't find anywhere that specifies what the amount is. I thought it was $10,000 but then I heard it was $20,000.

Also, do they report your gross earnings, before things like postage costs and fees are deducted? I assume they do and then you're responsible for declaring the postage, stock costs and fees as tax deductions?

Thank you! (I only opened my store in late July)

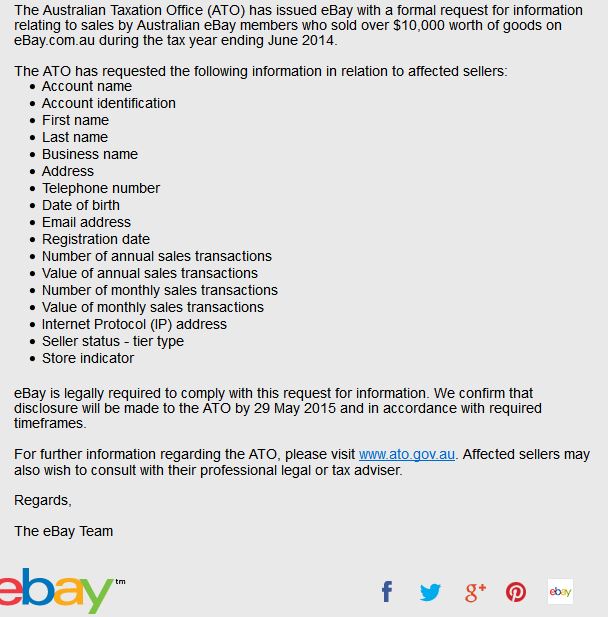

It used to be quite a high figure. ( around $60,000 ) then was dropped to $20K and dropped again recently to $10K. This is gross earnings including postage costs. Ebay sent a message to all sellers affected by the changes around June 30. The reduction and message came without warning and caused quite a stir with many claiming ( hoping ) it was a scam message.

The moral of the story is that the ATO are getting much better and more sophisticated at data matching and are sharing their information with Centerlink etc. It is getting fairly risky to try to run a business ( or very profitable hobby ) on ebay without declaring the income.

Personally I declare all ebay income to the ATO these days, including sales I would have once regarded as private or hobby sales.

When does eBay report our earnings to the ATO?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 22-01-2019 12:24 AM

This is from a 2015 thread, info provided by past regular poster clarry100

This is the first time we have received one of these since we have been trading on eBay.

Anyone else?

Solved! Go to Solution.

When does eBay report our earnings to the ATO?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 22-01-2019 12:58 AM

When does eBay report our earnings to the ATO?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 22-01-2019 08:14 AM

Just because it was $10000 in the past it does not follow that it will be that level this year. It can be any level the ATO decides to make it and you only know what it is when you receive the notification from ebay.

Also, that is not the level at which you have to declare your ebay activity. You are supposed to declare from the first dollar. When your turnover is low it is quite possible/probable that there will be no tax payable but it must be declared.

When does eBay report our earnings to the ATO?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 22-01-2019 04:48 PM

When does eBay report our earnings to the ATO?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

on 22-01-2019 04:52 PM

If you buy with the intention of reselling for profit, then it's not a hobby.

That's the bottom line.

A hobby is just selling stuff you've got lying around the house.